When are you going to retire?

How did you make that decision?

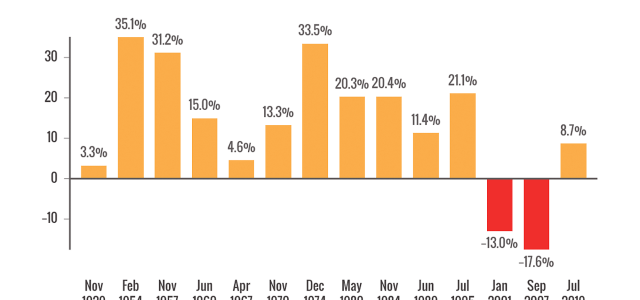

Many of us look at finances and health when we’re deciding when to retire.

Whether or not we realize

What money topics are the most taboo to talk about?

Earnings, debt, inheritance, or net worth?

For most of us, many financial topics are simply off-limits.1

That

If you’re like many investors, the thought of paying capital gains taxes on your successful investments might feel overwhelming. But what if there was a

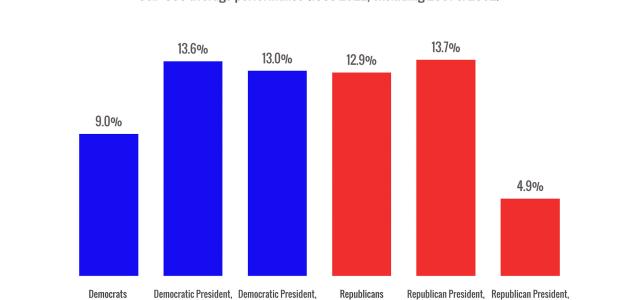

Smart investing doesn’t happen in a vacuum.

Current events matter, and this year, the 2024 Presidential Elections are taking center stage.

That’s rattling a

In a perfect world, every money decision we make would be totally rational.

We’d consider all of the facts. Then, we’d balance them with the risks to make the

What’s the first thing you think of when it comes to money?

Are your thoughts more positive or negative?

Whatever’s natural to you can speak to your money mindset